Financial Accountability

We at Kenneth Copeland Ministries Canada are committed to maintaining trust and providing transparency of our Ministry to our Partners and Friends across Canada.

Moreover, it is essentially required of stewards that a man should be found faithful proving himself worthy of trust. 1 Corinthians 4:2 (The Amplified Bible)

Financial Statement

- Kenneth Copeland Ministries Canada (KCM) has been a registered charity (Registration Number: 118979491 RR0001) in Canada for over 40 years. We operate under the Canadian Income Tax Act and Canada Revenue Agency (CRA).

- All contributions received by KCM Canada stay in Canada to fulfill our charitable purpose.

- Contributions made to KCM Canada are tax deductible under CRA guidelines and are receipted annually.

- KCM Canada submits annually a T3010 to the CRA which can be viewed on-line at the CRA website: http://www.cra-arc.gc.ca

- We have complied with CRA audits at various times and have successfully met all of their requirements.

- KCM Canada protects the privacy of all donors by keeping all personal information private adhering to the Canadian Privacy Act.

- We voluntarily submit to an annual audit by an independent public accounting firm in accordance with generally accepted accounting principles.

- We are overseen by a responsible Canadian Board of Directors of whom none are staff members of KCM Canada. Meeting regularly to establish policies, oversee operational budgets, capital expenditures and review KCM Canada’s progress.

- The KCM Canadian Board of Directors has within itself an audit committee, that reviews the Annual Budget and Annual Audit and they report their findings to the Canadian Board of Directors.

- KCM Canada does not have any outstanding debt and is committed to operating debt free now and in the future.

- At least 10% of all revenue is voluntarily set aside to give to other Canadian registered charities with purposes similar to KCM Canada.

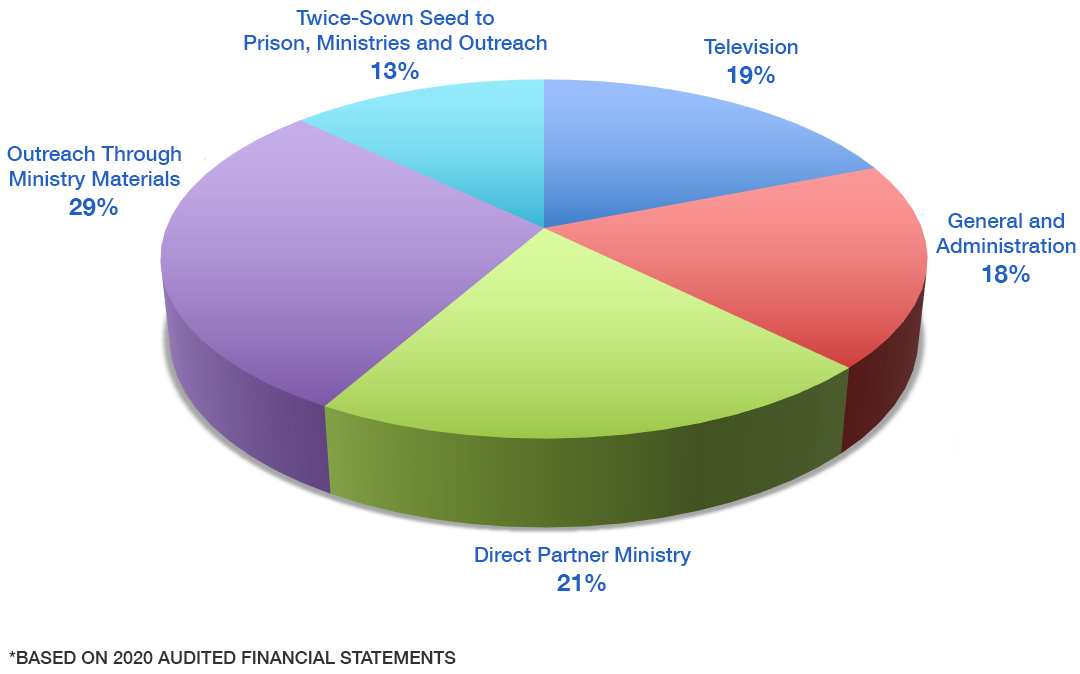

KCM Canada Cash Expenditure Graph